Do you want to sell subscriptions to your products and services on your own website, but don’t know what to choose for online payments, PayPal or Stripe?

First of all, many things depend on your membership selling software, namely, if it provides integration with Stripe and PayPal, how exactly is it developed? Do they have support for all the functionalities and options you need? Are there just basic tools supported or advanced alike, such as revenue analytics or sales and tax automation as well? Do you want to develop a custom app or product?

For example, with our ARMember – membership plugin, you can use both PayPal and Stripe to accept membership payments.

At the same time, you may not even have a website but still want to create a subscription with one of the popular payment platforms and sell your membership services directly – for example, via social networks, this is also quite possible!

While you can also offer one-time payments for plans, which is really easy with either payment platform, central to the membership site’s payment options are subscription and recurring payments.

So, today, we are talking about the global possibilities of Stripe and PayPal that are important for membership sites, including subscriptions, trial periods, and payment processing.

Looking at the Transaction and Service Fees

While choosing a product, the monetary aspect plays a major role in the decision making process. Let us look at it for both the products for gaining a comparative idea.

PayPal

Let us first understand the fee structure for PayPal. It can be a little complicated as it differs based on the region and type of transaction. The platform does not have any setup fees, thus the set up procedure is free.

Transaction Fees:

- Standard credit and debit card payments: 2.99% + 49 cents

- PayPal digital payments: 3.49% + 49 cents

- QR Code Transactions: 2.29% + 9 cents

- Venmo: 3.49% + 49 cents

Monthly Fees:

- PayPal Payments Advanced: US $5 per month

- PayPal Payments Pro: US $30 per month

Chargeback Fees: US $20 per chargeback (waivable with chargeback protection services, which incur additionally per-transaction fees)

Refund Fees: Transaction fee on refunds is not refunded; the original transaction fee amount is charged.

Instant Transfer Fees: 1.5% of transfer value, minimum fee of 50 cents

This is an overview of the PayPal transactions. However, if you want to look at its detailed document, access it here.

Stripe

Stripe has a transparent and straightforward pricing structure. For card transactions, Stripe charges 2.9% of the transaction amount plus a flat fee of 30 cents for a successful payment. However there are certain additional fees for different circumstances.

- Manually Inserted Cards: 0.5%,

- International Cards: 1.5% (additional 1% for currency conversion, if required)

- ACH Debit Cards: 0.8% per transaction (maximum fee $5.00

- Alternative Methods like iDEAL: 80 Cents/transaction

- 3D Secure Authentication: 3 cents per business and tailored for custom pricing accounts

This pricing model provides flexibility and efficiency for businesses of all sizes using Stripe’s services.

Payment Methods

Both platforms are sort of the key competitors on the market – so in case of giving your members a range of options to pay, you should not experience any limitations – except some only locally supported gateways.

| Payment Method & Features | PayPal | Stripe |

|---|---|---|

| Credit Cards | Yes (Visa, Mastercard, American Express, Discover, etc.) | Yes (Visa, Mastercard, American Express, Discover, etc.) |

| Debit Cards | Yes (connected to a bank account) | Yes (connected to a bank account) |

| Bank Transfers (ACH) | Yes | Yes (ACH debit and credit) |

| E-wallets | Yes (PayPal balance) | Works with third-party wallets |

| Buy Now, Pay Later | Yes | Integrations with third-party BNPL providers |

| International Payments | Multiple currencies | Multiple currencies |

| Recurring Billing Support | Yes | Yes |

| Automated Invoicing | Yes | Yes |

- PayPal offers its own built-in e-wallet for payments, while Stripe requires integrations with third-party wallets like Apple Pay or Google Pay.

- Stripe doesn’t support some of the payment options for invoicing (MobilePay, Click to Pay).

- Some digital wallets don’t support automatic recurring payments needed for subscriptions.

- With both payment platforms, you can define subscription plans in different currencies to charge the subscriber (fees may vary).

Also make sure to check out the official website for current commission amounts and any specific limitations.

Stripe vs PayPal: Selling Subscriptions & Recurring Billing

PayPal provides a straightforward way to sell subscriptions – this option is built into PayPal Checkout (find Subscriptions from the App Centre or from your Business account dashboard).

You can even create your PayPal sandbox environment to test your subscriptions flow without the need to use real funds.

For this, you will need to define what you’re selling as a “Subscription Product” (e.g., fitness membership) and then create specific “Subscription Plans” within that product (e.g., monthly or yearly memberships). You provide a name and type for your product – and then PayPal generates a unique ID for it. When a product is ready, you can create subscription plans that specify details like pricing, billing cycle (monthly, weekly, etc.), and any trial periods you offer.

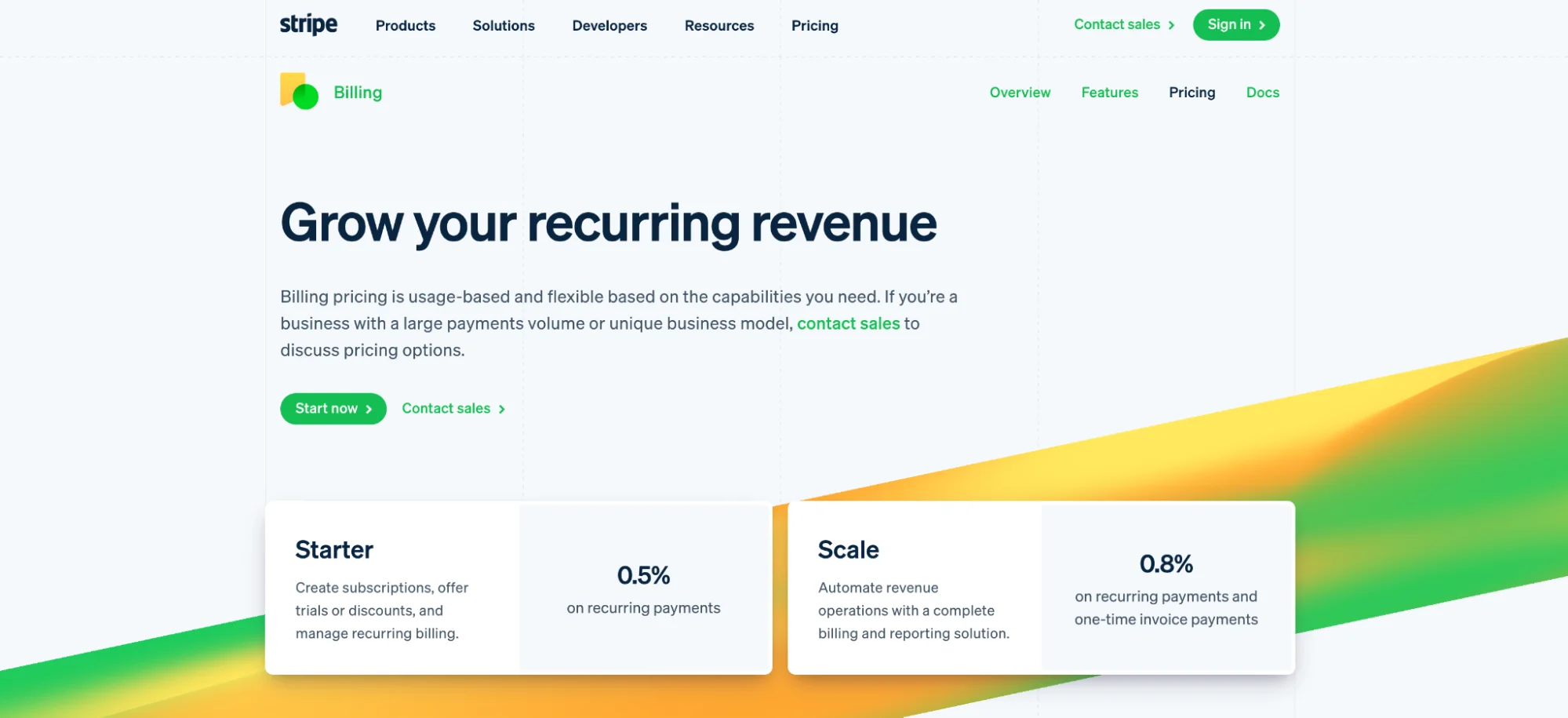

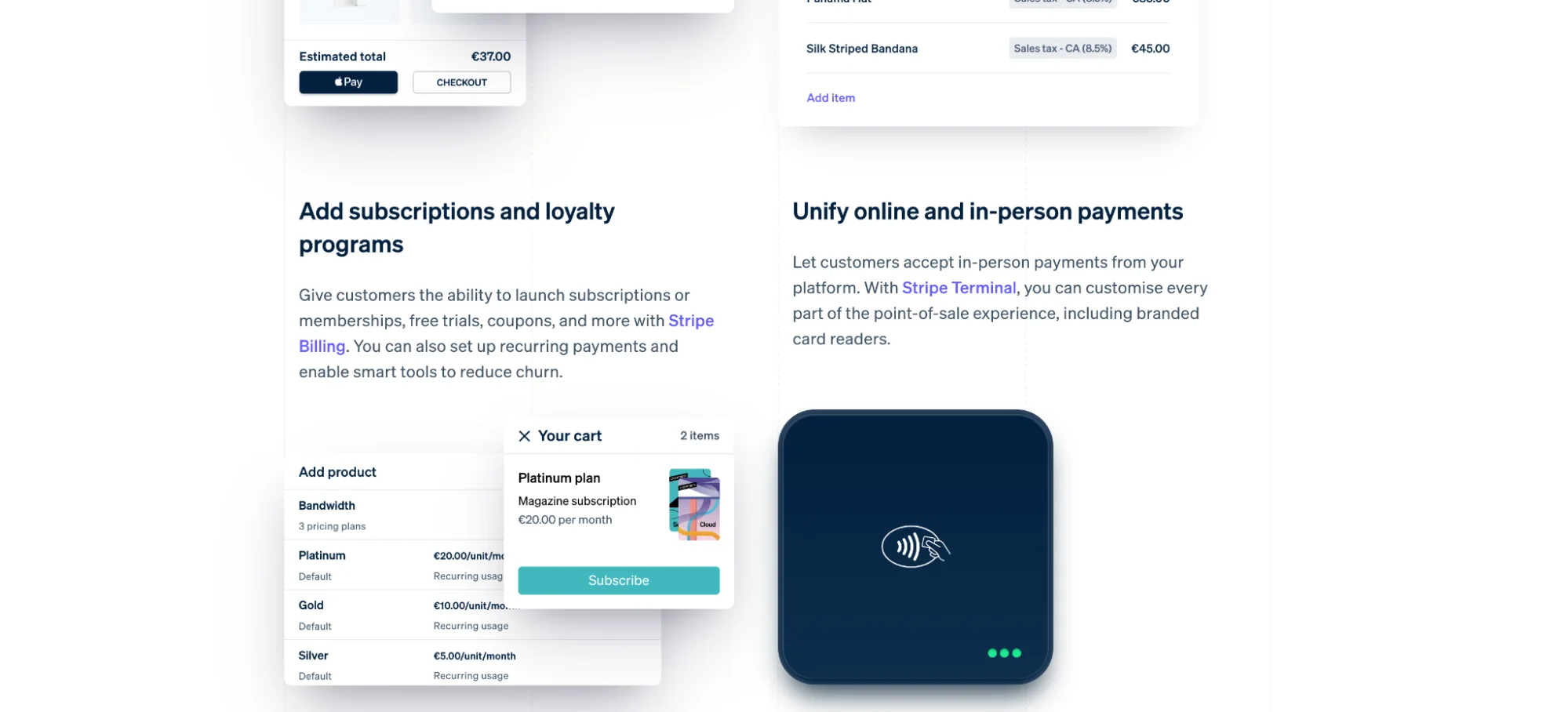

With Stripe, you’ll also need to establish the general categories of what you’re selling (e.g., software plans, monthly deliveries) – they will be used for your specific subscription options.

You’ll also be able to create variations within each product that detail the specifics of your subscription service (like pricing, billing cycle (monthly, annually, etc.), and any trial periods you offer).

Subscription Management: Upgrades & Downgrades

How are you going to manage different membership tiers with the help of payment gateways, such as Stripe and PayPal? Offer free trials, and easily handle upgrades or downgrades, etc.

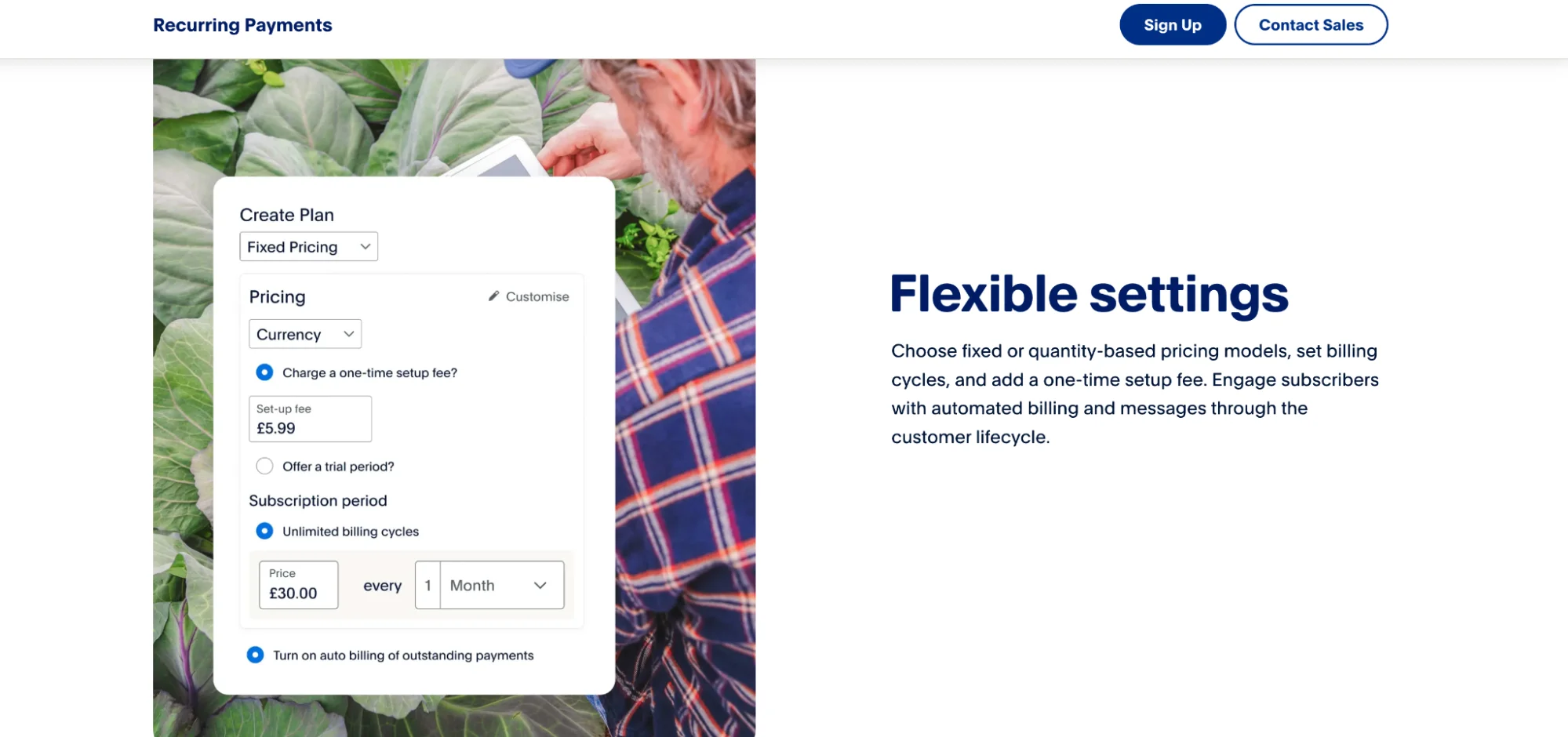

PayPal offers a wide variety of options for managing these aspects.

- Customers can upgrade or downgrade to subscription plans under the same product.

- The new upgrade/downgrade price is effective starting on the next billing cycle.

- Your members can easily change a subscription plan.

- “Soft cancellation” facility, that allows you to set a timeframe during which the member can easily reactivate their membership.

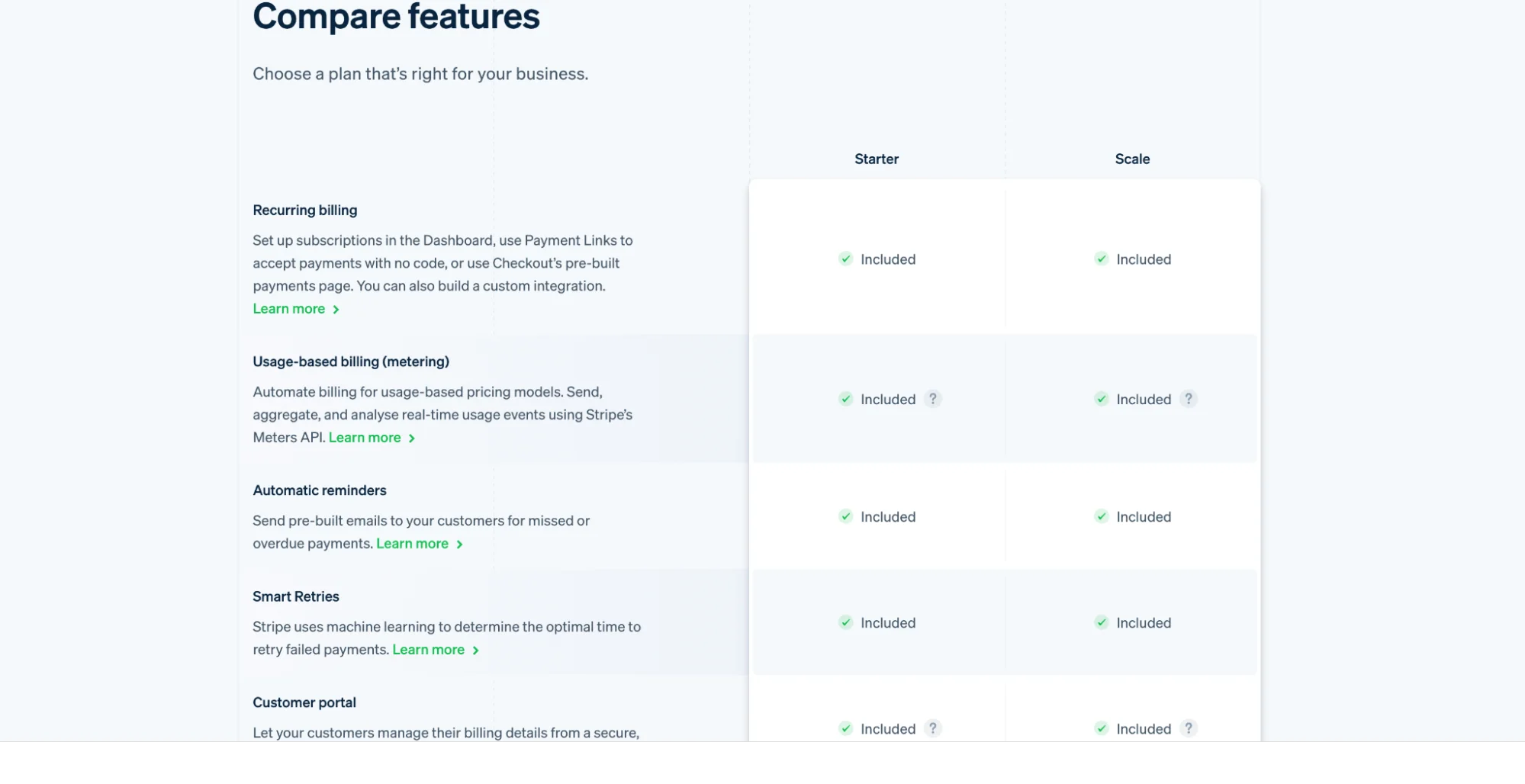

Stripe has the following capabilities:

- You can allow a customer to switch from one recurring subscription to another recurring subscription.

- If a customer has a free trial subscription, switching to a paid subscription creates an invoice and starts a new billing period from the change date.

- For changes of a subscription at the end of its billing cycle, consider using a subscription schedule.

Offering a Trial Period

To entice more potential members, memberships are often sold with a so-called trial period period, which offers subscribers a chance to try your product for free/at a discount before committing to a paid plan. And then, trial converts to paid subscription after the trial period.

How do both systems work in terms of managing trial periods? Let’s list the basics of PayPal first:

- PayPal allows you to have up to 2 trial periods per plan.

- You can create a paid trial by setting up a setup fee to charge the subscriber before the subscription begins, typically for items that aren’t part of the regular subscription billing.

- You can update the subscriptions’ start date as long as it’s in the future.

Stripe:

- You may charge a one-time fee or add on at the same time as starting a trial.

- Stripe subscriptions with a trial period require no upfront payment.

- Free trial auto-cancels without payment.

Concluding on What’s Better for Membership Site: Stripe vs PayPal

Get up and running fast with your membership site using one of the most popular payment platforms: Stripe or PayPal. What takeaways do we have based on today’s research?

- With both payment systems, you can accept payments with a range of credit cards, digital wallets, and bank transfers.

- The process of upgrades and downgrades seems a little bit more different to implement with Stripe than PayPal.

- PayPal makes it smooth to even accept paid membership subscriptions via social networks (Facebook, Instagram, and X) – if you don’t have a website. This works as easily as sharing a dedicated PayPal link with your customers.

- PayPal allows you to use volume-based and tier-based pricing models for your subscription plans.

- Both Stripe and PayPal offer APIs, which means if you have your own product user interface, you can customize APIs and integrate them into your membership product to use subscriptions and recurring payments.

Learn More: